Account Summary

Account Summary Account Summary

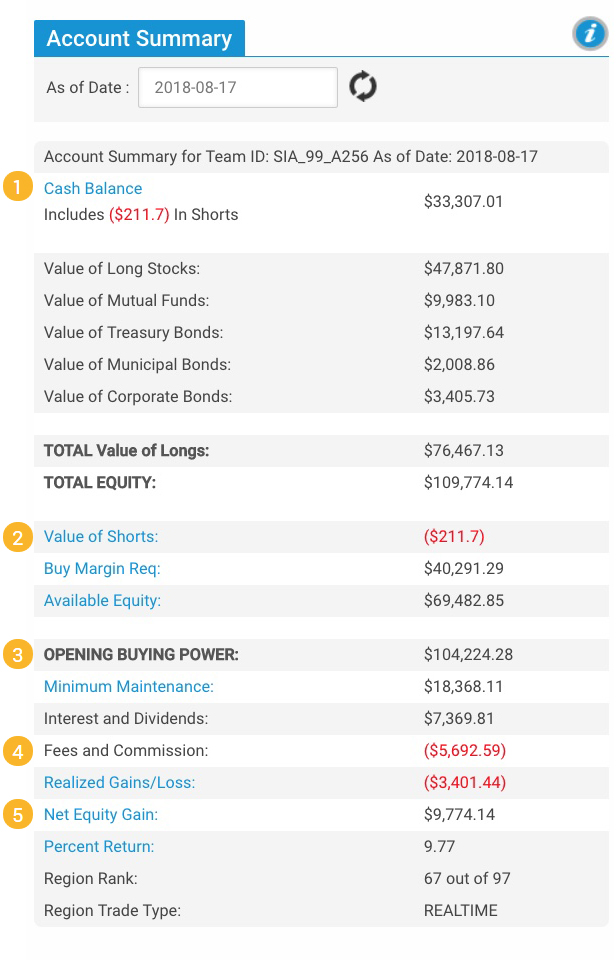

Account SummaryYour Account Summary displays your portfolio’s current financial information including total equity, buying power, and realized gains and losses.

Your Cash Balance is the amount of cash spent or earned from the initial $100,000. This includes dividends, interest, and proceeds from the sale of stock, mutual funds and bonds. If the number is negative, this is the amount of money you have borrowed on margin.

The Value of Long Stocks, Mutual Funds, Treasury Bonds, Municipal Bonds, and Corporate Bonds represent the current values of each of the securities you currently hold. Most of your stock, mutual fund, and bond trades are considered long positions.

The Total Value of Longs = long stocks + mutual funds + treasury bonds + municipal bonds + corporate bonds.

Total Equity is the sum of the Cash Balance plus the Total Value of Longs. The Total Equity is the number that is used to determine rankings.

The Value of Shorts is the current value of all stocks held in a short position (i.e., those that were sold short). It is the amount of money required to short cover the stock and is always displayed as a negative dollar amount. When you short sell, you borrow stock from a broker to sell with the hope that its price drops, so you can buy it back at a lower price. In The Stock Market Game, you can only short sell stocks.

The Value of Shorts is updated daily and either added to or subtracted from the Cash Balance. This process is called mark-to-market and ensures that the total equity is accurate. NOTE: These calculations will not appear in Transaction History.

The Buy Margin Requirement is the amount of collateral needed to meet the initial margin requirement when buying on margin. When you buy on margin, you borrow money to invest.

Formula: The Buy Margin Requirement = [(2/3) x (Value of Long Stocks + Value of Mutual Funds +|Value of Shorts|)] + (.04 x Value of Treasury Bonds) + (.10 x Value of Municipal Bonds) + (.25 x Value of Corporate Bonds). For this formula, use the absolute value (positive value) of the Value of Shorts.

Example: Buy Margin Requirement = [(2/3) x ($127,199.40 + $0 + $0)] + (0.04 x $1,322.52) + (0.10 x $10,539.00) + (0.25 x $0) = $85,906.50.

Available Equity is the amount of equity available for additional buy and short sell transactions. If this amount is negative, all buy and short sell transactions will be rejected.

Formula: Available Equity = Total Equity - Buy Margin Requirement.

For this formula, use the absolute value (positive value) of the Value of Shorts.

Example: Available Equity = $108,042.59 - [(2/3) x ($129,197.50 + $0 + $0)] + (0.04 x $1,322.52) + (0.10 x $10,539.00) + (0.25 x $0) = $22,136.09.

Return to TopOpening Buying Power is the total amount of money available for stock, mutual fund, and bond purchases, as well as short sales. During the trading day, this number will be impacted by any sales or purchases of securities. On the next business day, the opening buying power will be adjusted to include today's activity.

Opening Buying Power is one and one half Available Equity. For example, each SMG team begins the game with a Cash Balance of $100,000, but they have an Opening Buying Power of $150,000, accounting for the ability to buy on margin.

Formula: Opening Buying Power = Available Equity x 1.5

The Minimum Maintenance is the minimum margin requirement that a team portfolio must maintain after buying on margin. Your team will receive a margin call if the Total Equity in your portfolio falls below 30% of the value of your long and short stock positions + mutual fund positions + (.024 x value of treasury bonds) + (.06 x value of municipal bonds) + (.15 x value of corporate bonds).

Formula: Minimum Maintenance = 0.30 x (Value of Stocks + Mutual Funds + |Value of Shorts|) + (.024 x Value of Treasury Bonds) + (.06 x Value of Municipal Bonds) + (.15 x Value of Corporate Bonds.)

Net Interest is the amount of interest received on a cash balance minus any interest paid on a margin loan. All interest and dividend activity is shown on the Transaction History page.

Return to TopFees and Commission show the total amount of fees and commissions you have paid. Fees and commission are charged for each trade in your portfolio. A $5 commission fee is charged on every buy, sell, short sell, and short cover. Sells and short sells also charge SEC fees. Fees and commissions for each trade are itemized on the Transaction History page.

Realized Gains/Losses are profits or losses from the sale or short cover of a stock, bond, or mutual fund. Before the sale, they are called Unrealized Gains/Losses.

Return to TopNet Equity Gain is the amount of money your team has earned or lost since the beginning of your trading session. If the Total Equity in your portfolio is greater than its initial $100,000, the difference between the two numbers is considered a gain. If the Total Equity in your portfolio is less than its initial $100,000, the difference is considered a loss.

Formula: Net Equity Gain = Total Equity - $100,000

Formula percent return: 100 [ (Total Equity - $100,000)/$100,000 ]

When a student team is created prior to the start of the game session, the value of the S&P 500 on the first day of trading will appear in the right corner of the "Rankings" page (called "Starting S&P 500"). This value will not change during the course of The Stock Market Game session. If a team is created after the start of the game session, the "Starting S&P 500" will be the value of the S&P 500 the day the team is created.

Calculating a team's ranking with this method manually is an easy way for students to practice math skills. To do so, the following formula should be used:

| 100[ | (Total Equity - $100,000) | - | (Current S&P 500 Value - Starting S&P 500 Value)] |

| $100,000 | Starting S&P 500 |

Teams are ranked using S&P 500 performance or by Total Equity (check with your local coordinator for method used in your region).

In the "Rankings" page of each portfolio, teams will be listed in descending order according to their percent equity return. There will also be a column titled "Total Equity." Total equity refers to the team's current cash balance plus the value of their assets held in the long position.

In the "Rankings" page of each portfolio, teams will be listed in descending order according to their S&P 500 ranking. There will also be a column titled "Total Equity." Total equity refers to the team's current cash balance plus the value of their assets held in the long position. The team can use this total equity value to manually figure out their S&P 500 ranking.

Return to Top

Copyright © 2014 SIFMA Foundation.

All rights reserved. Provided for educational purposes without

warranty expressed or implied.