Enter A Trade

Enter A Trade Enter A Trade

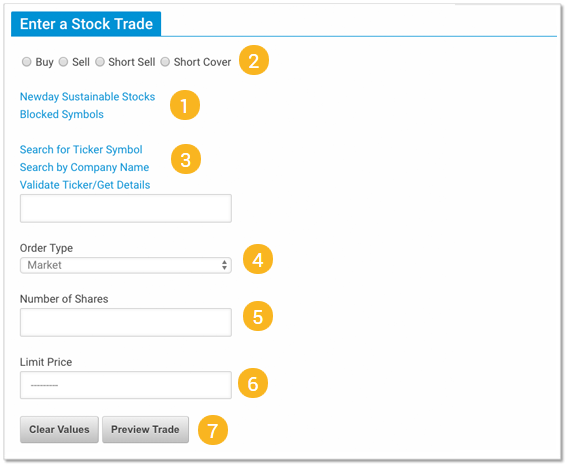

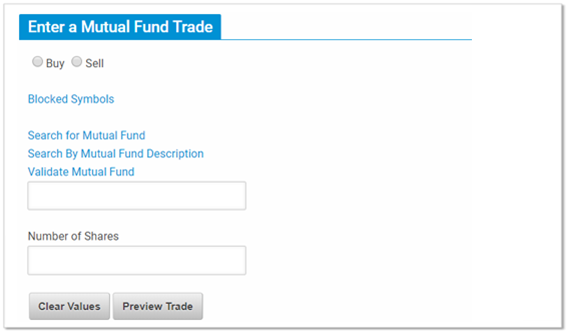

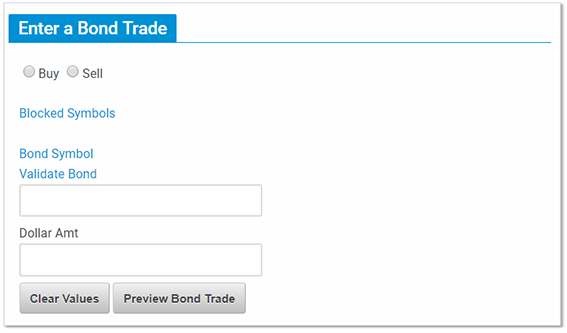

Enter A TradeSMG teams have the choice of three tradable securities: Stocks, Mutual Funds, and Bonds. Trading screens for Mutual Funds and Bonds are similar to the Stock Trade Screen, but do not include the options to Short Sell or Short Cover. They also do not show Order Type or Limit Price.

There are a variety of reasons a ticker symbol is blocked from trading in the SMG portfolio system. Check Blocked Symbols for them before entering a trade.

Return to TopTo enter a stock trade, first click on the circle indicating the type of trade your team would like to make. Your choices are:

Trade screens for mutual funds and bonds do not include options to short sell or short cover.

Return to TopBy clicking on the Ticker Symbol link (the Bond Symbol link on the Enter a Bond Trade page), you will be taken to a window where you can look up the ticker symbol for a security. You will need to know the ticker symbol in order to make a trade.

Return to TopUse the Validate Ticker (Validate Bond on the Enter A Bond Trade page) to confirm that the ticker or bond symbol you have entered into the associated field is correct. Clicking on Validate Ticker opens a Quote Summary for the security in question.

Return to TopEnter the number of shares (dollar amount when trading bonds) you want to trade in this box. Remember if the trade is a buy or short sell, you must trade a minimum of 10 shares. If you attempt to enter fewer than 10 shares, you will be asked to change your order to 10 shares or more. If the trade is a sell or short cover, you can trade less than 10 shares.

Note: Treasury bonds must be traded in increments of $100. Municipal and corporate bonds must be traded in increments of $1,000.

Return to TopFor stocks only: select the Order Type from the pull-down menu. If you would like the trade to go through at the market price, select Market and leave the Limit Price box empty. If you would like to set a limit on the price, select Limit. You must then enter your price limit in the box labeled Limit Price. When buying a stock or covering a short, the limit price is the maximum you are willing to pay per share. If you are selling a stock or short selling, the limit price is the minimum price at which you are willing to sell.

For example:

In Real Time regions, a limit price is compared to the stock price at the exact moment a trade is entered (or next market day's opening price if after hours). In End of Day regions, it is compared to the closing stock price on the day the trade is entered (or the next market day's closing price if after hours).

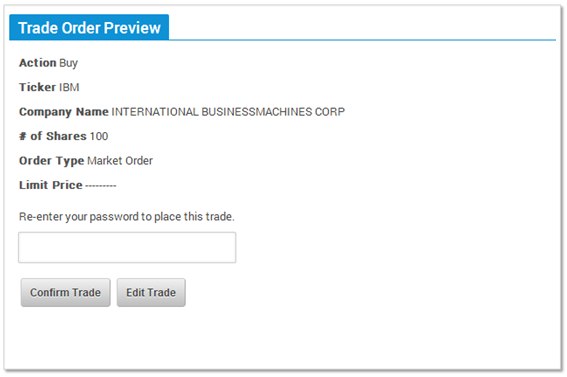

Click Clear Values if you would like to start over again or decide not to make the trade. Click Preview Trade button to bring up the Trade Order Preview screen. Be sure to look over the information closely to make certain everything is correct. If the information listed is not correct, click the Edit Trade button and correct the information. If the information is correct, enter your password and click Confirm Trade. Trades entered before 4:00pm ET, are processed that night. Trades entered after trading hours or on a day the market is not open, will be processed on the night of the next day the market is open.

If an error was found with the trade, a corresponding message will appear. Examples of error messages are:

Please refer to the help section in Transaction Notes for additional details on possible error messages.

Copyright © 2014 SIFMA Foundation.

All rights reserved. Provided for educational purposes without

warranty expressed or implied.