Gains and Losses

Gains and Losses Gains and Losses

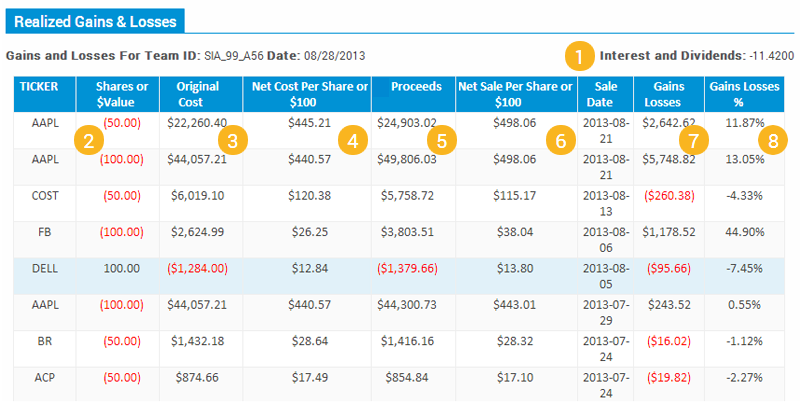

Gains and LossesThe Gains and Losses screen shows all realized gains or losses on security trades. Gains (or losses) only become realized when a security position is closed (i.e. sold or short covered). Interest received or paid and dividends received are also considered realized gains or losses. Any stock that is still held in your portfolio will not be listed on this page; gains and losses for securities still held in the portfolio are unrealized.

Interest and Dividends is the total interest and dividends received.

Formula: Interest and Dividends = interest received on cash in account + dividends received from securities held in the portfolio - interest paid on money borrowed (i.e., if you are on margin)

Return to TopShares or $Value are the number of stock or mutual fund shares sold or the dollar value of a bond sold (per $100 for municipal and corporate bonds or $1,000 for treasury bonds).

Return to TopIn a long position, the Original Cost is the total amount paid (including fees and commission) for the security you purchased.

Formula: Original Cost (stocks) = Net Cost per Share x Shares

Formula: Original Cost (bonds) = $100 x $Value

Original Cost (amount received from short sale) = $24.98 x 50 = $1,249.49

In a long position, the Net Cost Per Share or $100 per bond is the cost of each share of stock or mutual fund when purchased, including commission fees or the dollar value/$100 for a bond.

Formula: Net Cost Per Share or $100 = Original Cost / Shares or $Value

Net Cost Per Share = $1,249.49 / 50 = $24.98

For securities in the long position, the Proceeds are the amount received on the sale of the security, minus the commission.

Formula: Proceeds = Net Sale Per Share or $100 x Shares or $Value (The Net Sale Price already includes the cost of commission fees.)

Proceeds (amount paid when the stock was short covered) = $25.78 x 50 = 1,289.28

The Net Sale Per Share or $100 is the price per share when sold, minus commission fees for stocks and mutual funds and the Net Sale Per $100 of bonds, minus commission fees.

Formula: Net Sale Per Share or $100 = Proceeds / Shares or $Value

Net Sale Price = $1,289.28 / 50 = $25.78

The Gains or Losses is the dollar amount earned or lost on that trade.

Formula: Gain (or Loss) = Proceeds - Original Cost

Gains or Losses = $1,289.28 - ($1,249.49) = -$39.79 (loss)

The Gains or Losses % is the percent that you have made or lost on a trade.

Formula: Gains or Losses % = Gain (or Loss) for a security / Original Cost of that security.

Copyright © 2014 SIFMA Foundation.

All rights reserved. Provided for educational purposes without

warranty expressed or implied.